Study: Most Veterans Already Well-Covered by Health Insurance

Click to Enlarge: Data on veteran employment status were weighted to be nationally representative. VA indicates Department of Veterans Affairs. Source: JAMA Network Open

PALO ALTO, CA — In 2014, Congress enacted the Choice Act, followed by the MISSION Act in 2018. Introduced in response to concerns that delays in receiving VA care were negatively impacting veterans, these legislations were designed to simplify the process for veterans to access VA-purchased care.

While research has shown that the use of VA-purchased care increased after these laws were passed, there have not been corresponding improvements in mortality, even among the sickest patients, said Todd Wagner, PhD, professor in the Department of Surgery at Stanford University and director of the Health Economics Resource Center at the Palo Alto VA Healthcare System.

This led Wagner and his colleagues to ask, “Why is this happening?” One possible explanation, Wagner said, is that veterans have more than one source of health insurance, and these laws just changed the proportion who were getting care from VA—known as payer shifting.

“To understand and inform legislation on access to VA care, it is essential to examine how insurance coverage for U.S. veterans has changed over time, given that insurance coverage enhances access by reducing the cost of care,” Wagner and his colleagues wrote in JAMA Network Open, where they published results of their new study examining how many veterans had more than one source of insurance and how that evolved.1

The researchers conducted the cross-sectional study using national survey data from about. 3.6 million veterans from 2010 to 2021 who reported on health insurance enrollment. Participants were respondents who reported being a veteran across three national surveys with questions about health insurance—the National Health Interview Survey (NHIS), the American Community Survey (ACS) and the Behavioral Risk Factor Surveillance System (BRFSS), Wagner said. The researchers also analyzed data from the annual VA Survey of Enrollees, a survey designed to be representative of veterans enrolled in the VA healthcare system. Multiple surveys were used to ensure their “estimates were valid and not just random noise or error,” Wagner said.1

Across all surveys, the researchers extracted demographic details, including self-reported employment status, race and age. To examine health insurance coverage among veterans over time, the analysis was divided by age. The study also compared coverage rates based on veterans’ self-reported health status and household income and analyzed coverage by race and ethnicity, focusing on groups historically considered at higher risk for limited access to care.

Veterans Well-Insured

Overall, veterans are well insured, the researchers found. “If you include VA coverage, which is technically a benefit and not health insurance, then almost all veterans—95%—have at least one source of coverage,” Wagner told U.S. Medicine, adding he was surprised at how many veterans are enrolled in other forms of health insurance aside from VA coverage. “Of those who enroll in VA, 80% have more than two sources.”

Specific findings included the following:

- The composition of health insurance coverage among veterans changed over time. During the decade of survey collection, there was decline in private insurance accompanied by a rise in Medicare enrollment.

- While almost all veterans had health insurance, most veterans did not enroll in VA health coverage. Those without private insurance were more likely to enroll in the VA healthcare.

- Enrollment in the VA increased over time for both men and women. In 2010, 20.6% of women veterans and 25.7% of men were enrolled in the VA. By 2020, 33.6% of women and 35.3% of men enrolled.

- Insurance coverage increased with age, and insurance coverage improved between 2010 and 2021 across all age groups, with the biggest change over time seen among younger veterans. Coverage for veterans aged 65 years and older was nearly universal.

- Unemployed veterans consistently reported the lowest levels of insurance coverage. Retired veterans and those out of the labor force had the highest coverage rates.

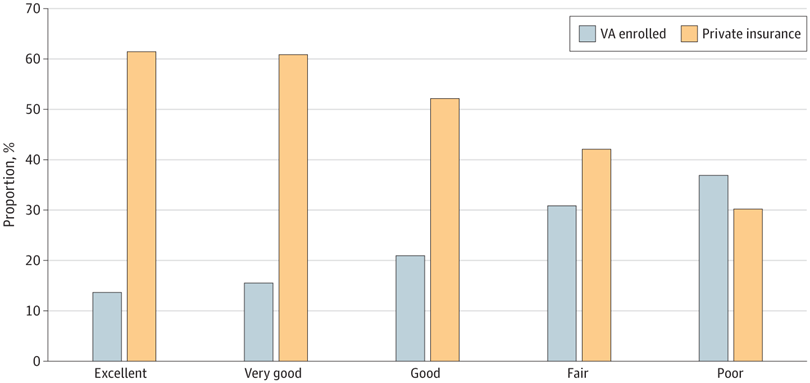

- Individuals with higher VA reliance reported lower health status and lower income. Veterans who self-reported having excellent health had considerably lower VA enrollment rates than veterans who self-reported their health as good, fair or poor.

- Veterans in different racial and ethnic groups all reported high levels of insurance coverage (91%-99%). There were no large discrepancies by racial or ethnic groups.

Their findings provide important insights into the potential policy effects of further legislative efforts to expand access to VA healthcare, the researchers wrote, noting, “First, efforts to expand VA coverage to address unmet needs must consider how changes will affect veterans with dual coverage.”

“Most people in society, including policymakers, want to help veterans access needed care,” Wagner said. “However, the best way to improve access is unclear. Often easy fixes, like the Choice Act and the MISSION Act, come at a cost and create unanticipated challenges,” he continued. “VA spending has increased rapidly since 2014, and yet we’re not seeing commensurate increases in outcomes. That should concern taxpayers, and we owe it to taxpayers to come up with scientific explanations.”

“Solving the access problem is not the same as solving insurance eligibility,” he said. “Most veterans have multiple sources of coverage, as we’ve shown.”

- Wagner, T. H., Schmidt, A., Belli, F., Aouad, M., Gehlert, E., Desai, M., Graham, L., & Rose, L. (2024). Health Insurance Enrollment Among US Veterans, 2010-2021. JAMA Network Open, 7(8), e2430205. https://doi.org/10.1001/jamanetworkopen.2024.30205